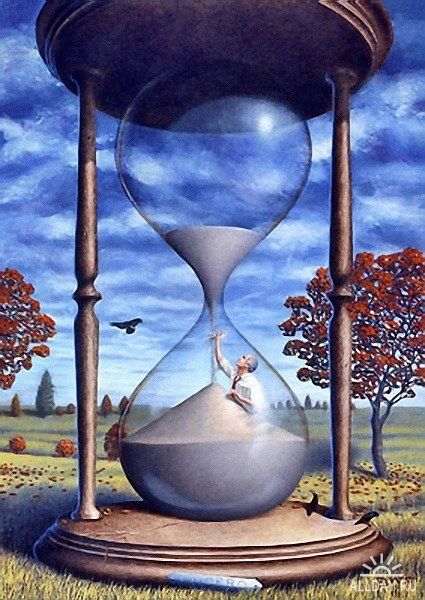

Safeguarding against Financial Exploitation: Estate Planning for Cognitive Decline In this overview of estate planning for cognitive decline, we examine signs of dementia and the role of estate planning in protecting our aging loved ones. The National Institute on Aging (NIH) article, “Managing Money Problems for People With Dementia,” sparked our discussion on estate plans and cognitive decline.

It is becoming more common for families to encounter challenges and new issues in needing to help loved ones safeguard assets from fraud and exploitation. This article shares practical strategies to protect vulnerable individuals when we notice signs of dementia.

Cognitive decline, particularly associated with conditions like Alzheimer's disease, poses significant risks for financial exploitation. Individuals grappling with dementia may struggle to manage bills, discern trustworthy individuals, and comprehend complex financial transactions. This vulnerability makes them prime targets for fraud and abuse. Here's a closer look at common forms of exploitation:

To combat financial exploitation, it's essential to understand the legal safeguards available and to assess the individual's capacity to enter into agreements. Here are key considerations:

Legal Capacity: Contracts and agreements are enforceable only if both parties have the legal capacity to enter them. Individuals with Alzheimer's or cognitive impairment may lack this capacity, rendering contracts voidable.

Capacity Assessment: Assessing mental capacity is crucial in determining the validity of agreements. Physicians, family members and legal experts play a vital role in providing testimony and evidence of cognitive decline.

Signs of dementia are sometimes slow to appear or hard to detect. The National Institute of Aging pointed out that financial management is one of the first signs of cognitive decline affecting a loved one.

Estate planning helps prevent loved ones with dementia from losing money or property to scammers or unscrupulous people. It is crucial to establish financial powers of attorney before signs of dementia and enable a trusted family member to oversee bank accounts and pay bills for a loved one. Trusts are another tool that helps to safeguard a loved one’s assets.

Estate planning for cognitive decline requires careful consideration and proactive measures to protect vulnerable individuals from fraud and financial exploitation. Families can confidently navigate these challenges by understanding legal safeguards, assessing capacity, and seeking expert guidance. Are you ready to safeguard your loved one's future? Schedule a consultation with our team today and take the first step towards comprehensive estate planning.

Schedule your phone consultation: THE LAW OFFICES OF CLAUDE S. SMITH, III

Safeguarding against Financial Exploitation: Estate Planning for Cognitive Decline

Reference: National Institute on Aging (NIH) (Oct. 3, 2023) “Managing Money Problems for People With Dementia”

Legal problems are extremely stressful, especially when your family, your health, or your freedom are at stake. At this point in time, you may not even be sure what kinds of questions you need to ask a lawyer, but that’s entirely normal. Whether your situation involves family law, estate planning, elder law, a criminal charge, or a personal injury, we will start by giving you all the information you need.

The way we see it, you deserve to get this information directly from an expert. That’s why we make it easy for you to get in touch with your lawyer, and we never ask you to sit down with a paralegal or assistant instead.

As our relationship continues, we will keep you updated about the status of your case every step of the way. Your lawyer will reach out regularly to tell you about any new developments, and he will also be happy to answer any questions you have throughout the process.