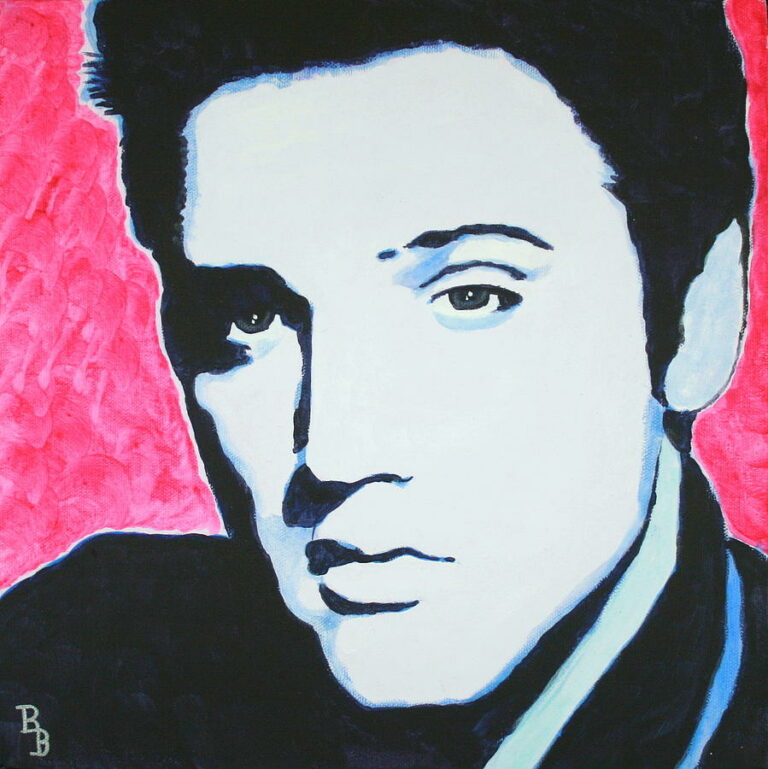

Elvis Presley's Estate Planning Mistakes: Lessons for Us All- Even the King of Rock 'n' Roll wasn’t immune to estate planning mistakes. Elvis Presley passed away in 1977 with a net worth of around $5 million. Nevertheless, poor estate planning resulted in significant financial challenges for his daughter, Lisa Marie Presley, who inherited the estate at age 25. Unfortunately, the saga of estate mismanagement continued with Lisa Marie's untimely death in January 2023. This article examines the lessons we can learn from these oversights.

Elvis relied on a basic will instead of a more comprehensive estate plan, such as a trust. While wills provide instructions for asset distribution, they don't protect beneficiaries from probate. This led to significant legal costs and delays, reducing the estate’s value. Furthermore, only a fraction of his estate remained after creditors, unscrupulous business partners and the IRS took their share. Kiplinger details how these mistakes haunted his daughter, Lisa Marie Presley.

Elvis was generous and free spending. However, his estate planning didn't account for this. As a result, much of his inheritance went to creditors rather than his daughter. However, creditors weren't the only ones claiming what Elvis left behind. The most significant loss was to the IRS, which claimed that the estate tax was worth double the value of Elvis' estate.

Elvis trusted Thomas Parker, better known as Colonel Parker, with business management. However, Parker was a Dutch illegal immigrant with a history of mental instability. The Army discharged him following a "psychotic breakdown," and he had only served as a private. Parker's business deal entitled him to 50% of Elvis' profits and enabled him to sell Elvis' song catalog. He kept most of the profits, depriving the family of any royalties.

Between the IRS, creditors and Parker, the woes Elvis left his loved ones have one thing in common: They were avoidable estate planning mistakes. While few people trust their will to Colonel Parker, many leave behind a will that doesn't protect their loved ones. Advanced estate planning strategies, such as the creation of trusts, are much more reliable than a simple will.

A will is better than nothing, but it's only the start. Develop a comprehensive estate plan that includes a trust and a power of attorney, and follow these steps:

Don't let your loved ones face unnecessary financial difficulties. Develop a comprehensive estate plan with the help of our estate planning team.

Schedule your phone consultation now: THE LAW OFFICES OF CLAUDE S. SMITH, III

Elvis Presley's Estate Planning Mistakes: Lessons for Us All

Reference: Kiplinger (May 17, 2023) "Five Estate Planning Lessons We Can Learn From Elvis’ Mistakes"

Legal problems are extremely stressful, especially when your family, your health, or your freedom are at stake. At this point in time, you may not even be sure what kinds of questions you need to ask a lawyer, but that’s entirely normal. Whether your situation involves family law, estate planning, elder law, a criminal charge, or a personal injury, we will start by giving you all the information you need.

The way we see it, you deserve to get this information directly from an expert. That’s why we make it easy for you to get in touch with your lawyer, and we never ask you to sit down with a paralegal or assistant instead.

As our relationship continues, we will keep you updated about the status of your case every step of the way. Your lawyer will reach out regularly to tell you about any new developments, and he will also be happy to answer any questions you have throughout the process.